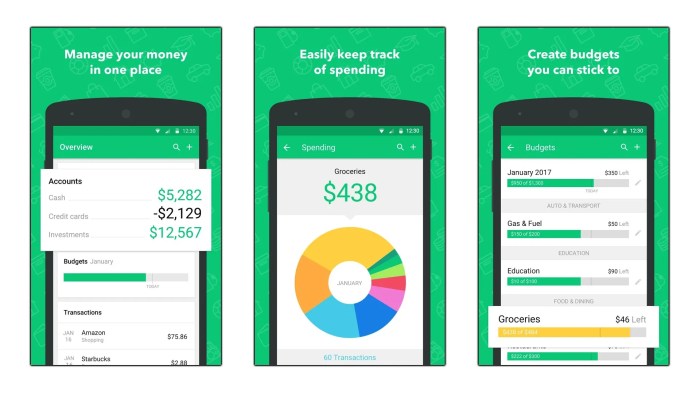

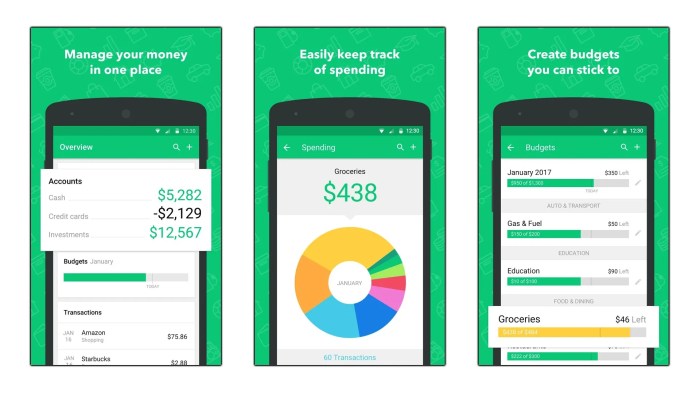

Welcome to the definitive guide to the best budgeting apps 2024. In this comprehensive overview, we’ll delve into the top budgeting apps available, exploring their features, benefits, and target audience. Discover how these apps can empower you to take control of your finances and achieve your financial goals.

From essential features like expense tracking and budgeting to advanced capabilities such as investment tracking and debt management, we’ll cover everything you need to know to choose the perfect budgeting app for your needs. Get ready to transform your financial management and unlock a brighter financial future.

Best Budgeting Apps of 2024: Best Budgeting Apps 2024

Managing your finances effectively is crucial for financial well-being. With the advancement of technology, budgeting apps have emerged as powerful tools to help individuals track their income, expenses, and savings. In this comprehensive guide, we present the best budgeting apps of 2024, discussing their key features, benefits, and target audience to empower you with the knowledge to choose the app that best suits your financial needs.

These apps leverage innovative technologies like artificial intelligence (AI) and machine learning (ML) to provide personalized insights, automate financial tasks, and assist users in making informed financial decisions. Whether you’re a seasoned budgeter or just starting your financial journey, there’s an app tailored to your specific requirements.

Key Features and Benefits of Budgeting Apps

Budgeting apps offer a wide range of features and benefits that can significantly enhance your financial management:

- Expense Tracking:Track your expenses meticulously, categorizing them to gain a clear understanding of where your money goes.

- Budgeting:Create customized budgets based on your income and financial goals, ensuring you stay on track with your spending.

- Financial Insights:Receive personalized insights into your spending habits, helping you identify areas for improvement and make informed financial decisions.

- Savings Tracking:Monitor your savings progress effortlessly, motivating you to reach your financial goals faster.

- Debt Management:Track your debts, create repayment plans, and reduce your overall debt burden.

Target Audience for Budgeting Apps

Budgeting apps cater to a diverse range of users with varying financial needs and goals:

- Individuals and Families:Manage household finances, track shared expenses, and work towards financial goals as a unit.

- Students:Monitor student loans, track expenses, and develop healthy financial habits.

- Freelancers and Entrepreneurs:Track business expenses, manage cash flow, and make informed financial decisions.

- Retirees:Plan for retirement, track expenses, and ensure financial security during their golden years.

Features to Consider When Choosing a Budgeting App

Selecting the ideal budgeting app requires careful consideration of essential features that cater to your financial management needs. Key elements to look for include expense tracking, budgeting, savings goals, and reporting.

Effective expense tracking allows you to monitor every dollar spent, providing a clear picture of your financial habits. This feature helps identify areas where adjustments can be made to optimize spending.

Budgeting

Budgeting features enable you to allocate funds to specific categories, ensuring responsible spending. By setting limits and tracking progress, you can stay within your financial plan and achieve your financial goals.

Take control of your finances with the best budgeting apps of 2024, empowering you to manage your money effectively. Stay informed about the latest financial trends and discover how these apps can simplify your financial journey. If you’re looking for a break from budgeting, immerse yourself in the captivating world of the best Nintendo Switch games of 2024.

Return to budgeting with renewed insights and a refreshed perspective, leveraging the power of these apps to achieve your financial goals.

Savings Goals

Saving for future expenses or financial milestones is made easier with savings goal features. These tools allow you to set targets, track progress, and stay motivated towards achieving your financial aspirations.

Reporting

Comprehensive reporting features provide insights into your financial patterns and performance. Reports can highlight spending trends, identify areas for improvement, and demonstrate progress towards your financial objectives.

Comparison of Popular Budgeting Apps

To help you make an informed decision about the best budgeting app for your needs, we’ve compiled a table comparing the top budgeting apps based on their features, pricing, and user reviews.

The table below provides a clear and organized presentation of the information, so you can easily see how each app stacks up against the competition.

App Comparison Table

| App Name | Key Features | Pricing | User Ratings |

|---|---|---|---|

| Mint |

|

Free | 4.5/5 |

| YNAB (You Need A Budget) |

|

$84/year or $11.99/month | 4.7/5 |

| EveryDollar |

|

Free | 4.2/5 |

| PocketGuard |

|

Free or $7.99/month for Premium | 4.3/5 |

| Goodbudget |

|

Free or $8/month for Plus | 4.1/5 |

Advanced Features for Power Users

Budgeting apps have evolved to offer advanced features that cater to the needs of power users. These features provide deeper insights into financial data, enabling users to manage their finances more efficiently.

Investment Tracking

Power users often have investments in stocks, bonds, and other financial instruments. Advanced budgeting apps allow users to track these investments, monitor their performance, and make informed decisions. The apps can connect to brokerage accounts, automatically import transaction data, and provide real-time updates on investment values.

Debt Management, Best budgeting apps 2024

Managing debt effectively is crucial for financial well-being. Advanced budgeting apps offer robust debt management tools that help users track their debts, create repayment plans, and optimize interest payments. The apps can calculate optimal debt repayment strategies, suggest debt consolidation options, and monitor progress towards debt reduction goals.

Custom Reporting

Power users often need to create customized reports for tax purposes, financial planning, or business analysis. Advanced budgeting apps allow users to generate custom reports that summarize financial data in specific formats. The reports can be exported to various file formats for easy sharing and further analysis.

Tips for Getting the Most Out of Budgeting Apps

Harnessing the power of budgeting apps requires a proactive approach. Here’s a comprehensive guide to maximize their effectiveness and achieve financial goals:

Set Realistic Budgets

Avoid setting unrealistic budgets that lead to discouragement and derailment. Start by tracking expenses to establish a baseline and identify areas for improvement. Allocate funds to essential categories, leaving a buffer for unexpected costs.

Track Expenses Diligently

Regularly record all expenses, no matter how small. This creates a detailed record of financial activity, enabling accurate budgeting and identifying potential savings opportunities.

Regular Review and Adjustment

Budgeting is not a static process. Regularly review progress, adjust budgets as needed, and make informed decisions based on actual spending patterns. This ensures alignment with evolving financial objectives and prevents complacency.

Wrap-Up

In conclusion, the best budgeting apps 2024 offer a powerful toolset to manage your finances effectively. Whether you’re a beginner or a seasoned financial expert, there’s an app that can meet your unique requirements. By embracing the right budgeting app, you can gain a clear understanding of your financial situation, make informed decisions, and achieve your financial aspirations.

Remember, budgeting is not just about restricting spending but about gaining control over your finances and empowering yourself to make the most of your hard-earned money. Embrace the power of budgeting apps and unlock the path to financial freedom and success.